Why Game Devs Should Understand the Federal Reserve, Explained

The Federal Reserve is confusing, but actually affects all of us, including game devs. Read on to understand why!

(This is a repost of my thread on Twitter/x.com)

I have been learning economics and finance as a hobby for 3 years, and teaching helps me learn so... Screw it! I just drank a honey lemon ginger tea & ate a veggie burger, let's write about why game devs should pay attention to the Federal Reserve (For Fun and Profit)! 🧵🏦💸

Interest rates are generally controlled by a country's central bank. In the US, it's the Federal Reserve, chaired by Jerome Powell. Here he is printing money with quantitative easing.

The main goal that the Federal Reserve has been focusing on over the past several years has been trying to get inflation under control. Too much inflation is bad, because with more money being printed, things cost more- a $100 bag of groceries in 2020, will cost $121 today. Boo!

To control inflation, the Federal Reserve changes interest rates. (Technically through the Federal Funds Rate.) By changing interest rates, it changes borrowing costs. Banks can loan money out, but they expect to be paid back... With Interest!

So how does this affect games? Well, if interest rates are lower, like the near zero rates we've been used to post-2008 Recession, then more money can be borrowed to stimulate the economy. Which means more businesses, tech startups, game companies, innovation, stonks!! 📈📈📈

So, after ‘08, why was there inflation? It took some time but there was a lot of "money printing", sorta. What actually happened was Quantitative Easing/QE. The Fed would buy things like bonds and give credit to banks by changing #'s in a computer, no paper money needed!

Sounds amazing! What's the problem? Well the bill comes due in the form of inflation, like we mentioned. So to get inflation under control (Deflation) the Fed does 2 things: raising interest rates and Quantitative Tightening

Raising interest rates is like lowering interest rates but the opposite, easy. QT is a lil more complicated and there's multiple methods but the most common involves... Doing Nothing! They simply let the bonds they bought mature and keep the money, thereby taking it out of the money supply.

The Fed is trying to get inflation under control. The Biden administration has a target of 2%. Last checked, we were a hair less than 3%, not good enough! The Fed (which is not elected and independent from the admin) is continuing to do its thing. More importantly: HOW DOES THIS AFFECT GAME DEVS

Currently interest rates are at 4-5%. This is relatively high compared to 08-'20, which will slow the economy. Why? 1) Investors can get around 4-5% return on investment virtually risk free, which means if they want to invest in a company they want more returns bc they love $$$

So $ will flow from "risky" companies to less risky assets. Unfortunately that often means people are less likely to take a chance on your experimental game company looking for their next big surprise hit. *I* know your studio is gonna make racks but *they* dont!

Reason #2- People and companies lower spending. Higher interest rates mean higher credit card payments, auto loans, mortgage loans (a 30 year fixed rate loan at 6-7% on a $400k median house is about $2-3k a month!). Less spending (70% of US econ is consumer spending) means a slowing economy *sadface*.

For game devs that means noobmaster69 can't buy those Robux, hats, and indie games when they gotta pay their landlords and grocery bills. So the idea is less money's coming your way. Oof.

3- Businesses will have less access to cheap low interest capital to invest in new projects, and may focus on existing things. Belt tightening means less innovation, new projects, new funding. Less new games, less innovative reporting :/ But things can work out!

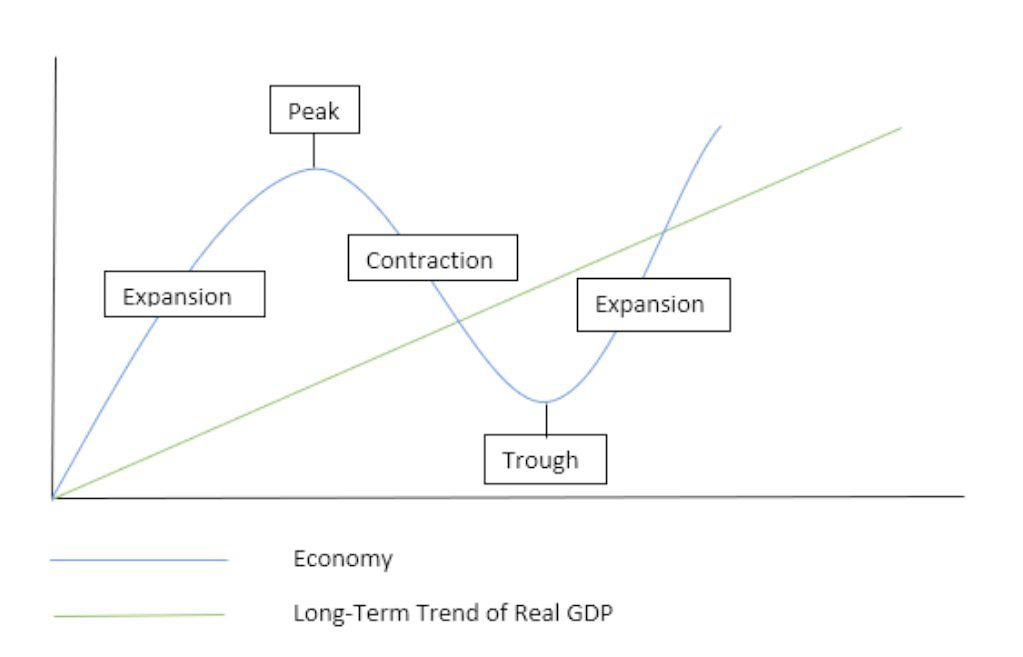

And all that's to say is a lot of bad circumstances aren't your fault! It's simply the economic climate we're in. And following the economy is just as important as the weather. And in a way, it does have seasons, like boom and bust cycles, and we're facing some stormy weather.

So how do you face stormy weather? Batten down the hatches, save money, stay connected. Ride out this cycle, keep your eyes and ears open, and you might find yourself riding the next boom. Economists are projecting a first interest rate cut by end of 2024, but no one really knows, not even Jerome Powell really. It all depends on the data. And if someone did know, well, hopefully they can throw a couple million bucks my way to help fund my next game!

Thanks for reading all this! This article and everything on my Substack are all completely free, and I still have a full time job, but feel free to subscribe for a month or two ($5 for one month!) to support more work like this!

Later Gamerz! And be safe out there.

Thank you Charles for the great write up and explanations of key terms and financial concepts. I thoroughly enjoyed the read!

Also discuss Japan’s low rate and its affect on games